The Ethereum price is on a roll and is undoubtedly one of the top performers in the last week.

At $1,020 as of writing (January 4), the ETH price is up a massive 31 percent on the last day of trading, stretching the USD by 47 percent in the past week of trading.

Accompanying the march to the new 2021 high are swelling trading volume that has more than doubled on the last day as per coin trackers.

Ethereum (ETH) Price Overview

The upsurge in ETH/USD prices also means the coin’s market cap is now above $113 billion, rising by almost 50 percent in the last week of trading.

At the time of writing, it appears that ETH bulls are aiming for the $1.4k level. Over the weekend, the digital asset’s prices rose from around $700 on January 1 to over $800, to spot rates, adding an impressive $300 in 36 hours.

Judging from participation level—signaling the influx of capital from both sets of investors (retail and institutions), the path of least resistance is northwards in the immediate and medium-term.

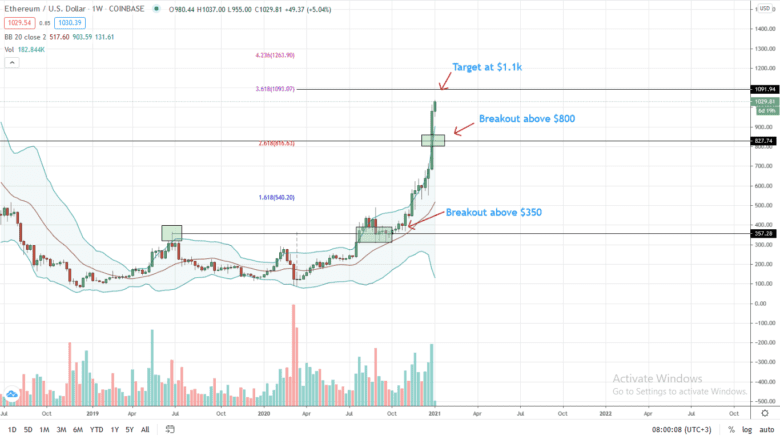

With prices easing past $800, the 2.168 percent Fibonacci extension level of Dec 2018 to June 2019 trade range, the next target is $1.1, the 3.168 percent Fibonacci extension level, and later, $1.4k, the coin’s all-time high.

A contraction from spot levels could see the ETH/USD price contract to Q2 2018 highs of around $800 (now support) before trend continuation.

Ethereum (ETH) Market Movers

The uptrend is firm, and bull riders are said to be institutions.

At the back of critical fundamentals in the next few weeks, the network will be refined to favor the platform’s wholesome growth of different facets.

For now, EIP-1559 will introduce Gas predictability, taming Ethereum miners keen on raising Gas limits to their favor. Despite doubts about the network’s security, developers are confident this is the first chess move to keep Gas from spiraling out of control.

After that, Rollups will follow, creating a multiplicative effect when merged with Sharding, which will be active in Eth2 Serenity.

Combined, Ethereum developers will by several folds slash the cost of transacting in Ethereum helping the platform blossom not only by making DeFi cheaper, but gamers will flock to a scalable platform pumping ETH prices.

Accordingly, investors are positioning themselves for price gains, with some even saying Ethereum will eclipse Bitcoin in the long-term.

As of press time, the Ethereum price is now more valuable than Goldman Sachs:

Ethereum Price Prediction

The Ethereum price is trading within a bullish breakout pattern.

Marking bulls triumph over $800 was a surge in market cap, trading volume, and a conspicuous bull bar.

At this pace, the ETH/USD price has broken past two sell walls in quick succession within a quarter. During this time, the ETH price has nearly tripled, rising from $350 to over $1k.

With a near perpendicular rise, every low above $800 may provide an opportunity for buyers aiming at $1.1k, the 3.168 percent Fibonacci extension level of Dec 2018 to June 2019 trade range.

The $800 level is the immediate support and is Q2 2018 high, marking peaks before the slump to $74.

Disclaimer: Opinions expressed are not investment advice. Do your research.