Solana prices are encouragingly expanding with rising crypto tides.

After deep losses suffered last month, SOL is now up double digits, adding 11 percent against the greenback with increasing trading volumes.

As of writing, traders expect more if SOL/USDT candlestick arrangement guides. But, if anything, buyers appear to be in the driving seat, bottoming up much to the delight of holders.

Solana Market Overview

From the daily chart, there has been an apparent revival of SOL prices. However, this is not to say buyers are out of the woods—yet. If anything, the uptick in trading volumes and price gains could be climactic, marking the end of gains of the last few trading days.

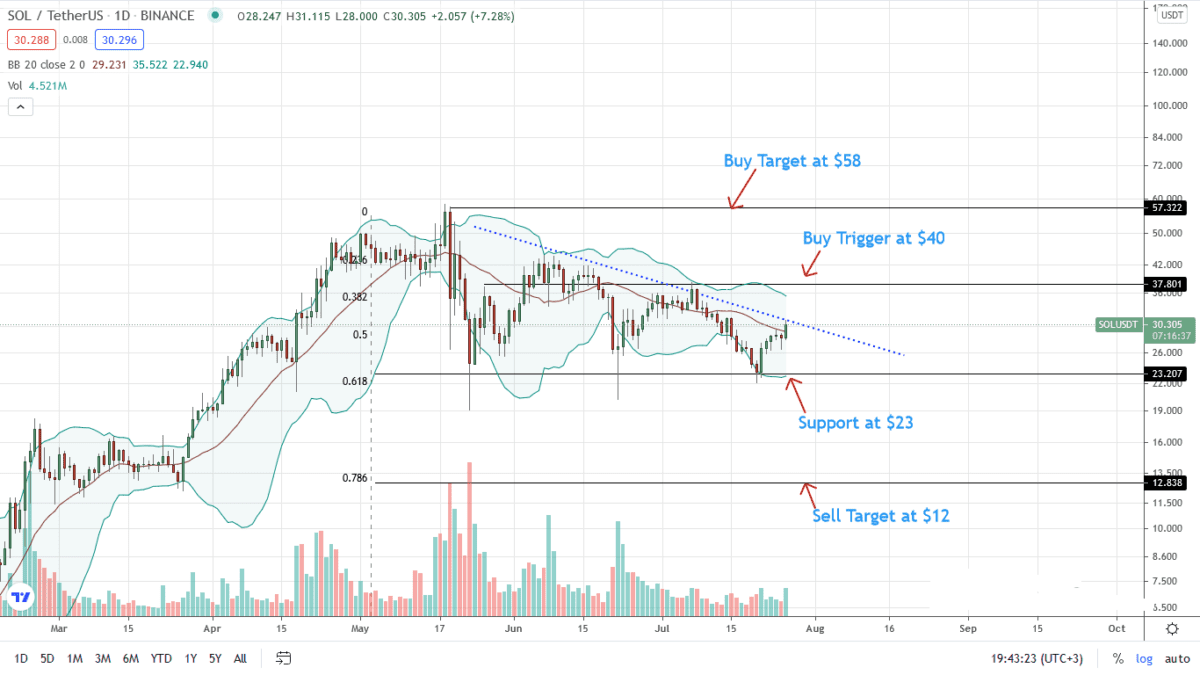

Overly, SOL/USDT prices are stuck inside a wedge with a marked-out support level at $23. Coincidentally, this flashes with May and June 2021 lows and is, therefore, a critical support level.

How prices react at this level will define the short and medium-term trend in the days ahead, especially if the breakout is to the downside.

As we advance, SOL bulls must edge past the resistance trend line and $40 for substantive gains as prices recover after deep drawdowns in the better half of Q2 2021.

Solana Market Movers

In the age of DeFi, participants desire fast settlement, scalability for the network to handle heavy-dApps, and negligibly low transaction fees.

It is precisely what Solana brings on board. The creators of the platform say the network is built for global adoption.

That is precisely the case because the primary drivers of SOL prices lie in the performance of DeFi. Therefore, there is a direct correlation between SOL prices and the TVL of DeFi.

As of writing, DeFi commands a TVL of over $72 billion, a figure which is up 48 percent on the last day alone.

During this period, SOL and most DeFi governance tokens prices rose in sync.

Accordingly, as TVL picks up and confidence rises, the project’s fundamentals would be the backbone of the next leg up above critical resistance levels in a buy continuation pattern.

Fundamentally, Solana Network’s strength is set to increase with the launch of audited staking pools.

Already, Solana is one of the most censorship-resistant. However, the foundation is working more to make the networks even more resilient by distribution staking validators.

Meanwhile, projects are working on bringing EVM compatibility to Solana.

As the blockchain improves on several fronts:

A core part of which involves funding projects building on the scalable platform:

Solana Price Analysis

The SOL price is up 11 percent on the last trading day, reading from development in the daily chart.

The surge of July 26 confirms the double-bar bullish reversal pattern of July 20 and 21. Notably, this reversal is from 23—a critical multi-month support level.

Ideally, every low should be a loading opportunity for aggressive SOL/USDT buyers targeting $40.

On the flip side, risk-on traders can wait for a conclusive, preferably high-volume close above the resistance trend line in continuation of last week’s gains. This will complete the reversal, opening up SOL for $40 and even $58 in the medium term.

Check out our updated Solana price prediction given SOL’s surge to a new all-time high.

Disclaimer: Opinions expressed are not investment advice. Do your research.