In Brief

- IOTA add a 24% gain to its price over the past week

- The IOTA price is among the top performers in the last week of trading.

- IOTA price analysis shows the buyers are now targeting $4 USD.

Trading over $2.10, the coin is up double digits and, in the process, attracting demand from investors, network users, and speculators.

As of May 4, a direct relation has emerged in the last few days trailing the coin’s exemplary performance, its organic search, and participation levels.

IOTA Market Overview

The IOTA price is trading at $2.1, adding 24 percent week-to-date and posting green versus the USD and BTC.

However, it is trailing versus ETH that’s charting new highs above $3.1k after gains last week.

Overly, candlestick performance favors IOTA bulls. From the daily chart, the IOTA/USDT price is trading within a bullish breakout pattern.

After cooling-off in mid-April, the bounce from the previous resistance-turned-support in the tail-end of the month confirmed a retest. It may be the foundation of possible buy trend continuation that may go on for the better part of May and even Q2 2021.

IOTA Market Movers

IOTA is a blockless Distributed Ledger Technology (DLT) angling to serve and spearhead innovation around machine learning.

The problem with IOTA–especially from early last year, was centralization concerns.

Through the Coordinator, the IOTA Foundation was on top of proceedings. The network was breached, causing the Coordinator and the platform to be frozen for over four weeks.

As a result, there has been concerted development to switch off the Coordinator and usher in IOTA 2.0 that’s completely decentralized, scalable, and cheap. These are some of the distinctive properties that make IOTA unique.

Unlike Bitcoin, IOTA uses the Proof-of-Work consensus algorithm but is infinitely scalable and energy-efficient.

The design of its “proof” also makes the network scale directly demand, a divergence from, for instance, Ethereum that’s periodically bogged by congestion and high Gas fees.

Towards IOTA 2.0, Chrysalis is the intermittent step before “Honey” and official activation.

Last week, Chrysalis went live, preparing for enterprise-grade adoption as it tagged along with several features.

Developers describe this launch as a “new dawn” and steps towards a machine economy. Of note, the network is now “lighter” following the reduction of transaction size by 92 percent:

IOTA Price Analysis

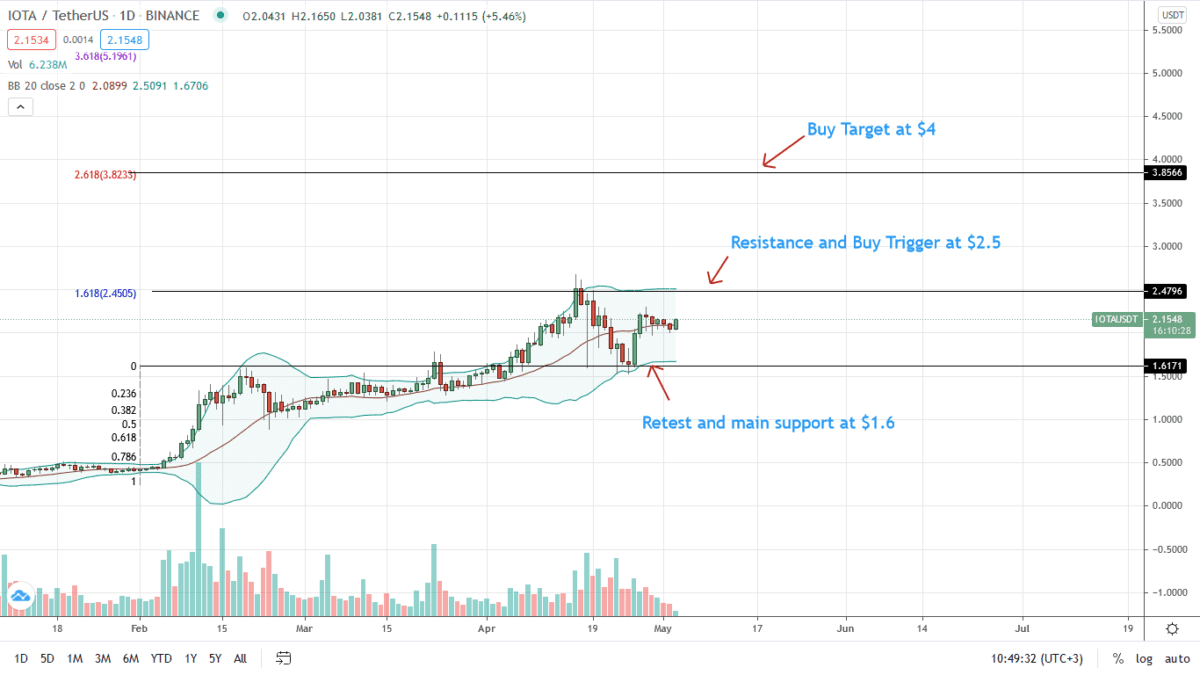

The IOTA price is trading within a bullish breakout pattern as aforementioned.

After early gains of April, the IOTA/USDT recoiled, falling back to Q1 2021 highs and rebounding in a retest. Presently, the IOTA/USDT price ranges between $1.6 and $2.5 – the 1.618 Fibonacci extension level of the Q1 2021 trade zone.

Technically, the consolidation after the confirmation of the 3-bar bullish reversal pattern between April 24 and 26 may provide an opportunity for aggressive traders to buy the dips aiming for April 2021 highs of $2.5.

On the other hand, risk-averse traders can wait for a comprehensive breach of $2.5 – April 2021 highs, as they target $4 – the 2.618 Fibonacci extension level.

Leaning on caution, more profound losses below $1.6, unwinding the three-bar bullish reversal pattern April 24 and 26 invalidates the uptrend.

Disclaimer: Opinions expressed are not investment advice. Do your research.